This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

Imagine a cruise ship full of retirees, chances are you were thinking of a ship filled with old people. Google thinks so too. Now imagine these retirees to be in their early 50’s, 40’s or maybe even 30’s – difficult to imagine? Impossible you say? Not if you believe the FI/RE movement. This movement named after the acronym, Financial Independence, Retire Early aims to get people out of the rat race and into retirement as early as possible. Let’s have a look what it is, how to be FI/REd and be critical if it is realistic to begin with?

“I wish I hadn’t worked so hard.”

– Bronnie Ware (The Top Five Regrets of the Dying.)

Where did the FIRE start?

Let’s start with where did it come from? The concept of being Financially Independent and Retire Early is not new and there are plenty of origins stories to think of. In the early 1960’s Joe Dominguez retired at the age of 31 and would later write the 1992 bestselling book Your Money or Your Life written with Vicki Robin. (See fulfilment, a key topic from this book discussed here.) This would for a lot of people form the foundation of the current FI/RE movement.

From the blogosphere, Mr. Money Mustache is hailed as the main man behind the current popularity of the FI/RE movement. He started blogging in 2011 and also retired at the age of 30. It should be noted though that many financially independents only heard about him after (almost) reaching FI/RE or at least well into their FI/RE journey, similarly he only heard about Your Money or Your Life late into his financial journey. Therefore, I am not sure if there is any statistics that could show any causation between any book or blog and the actual success of reaching FI/RE. In any case it has been a surging trend in the last decade since the great recession, and now again with the Corona depression gaining even more traction and there are communities around the world focussed on obtaining this wonderful goal (success rate unknown).

How to start a FIRE?

Retiring early depends on the financial independence part, and this makes it that main topics that you’d need to learn about are some financial basics, such as savings rate, investing and the concept of compound interest. Let’s see how these contribute to FI/RE.

Saving yourself into retirement

As I’ve discussed previously, the best way to increase your wealth is to tackle the difference between what you earn and what you spend. Increasing your savings rate can make a difference of years when looking at your retirement age.

In his book Early Retirement Extreme, Jacob Lund Fisker describes the relationship between savings rate and time to retirement, which allows individuals to quickly project their retirement date given an assumed level of income and expenses. Although the math in the book can seem a bit daunting at a quick glance and I won’t be going into that here, Be sure to check out my retirement grid to easily calculate how your spending habits affect your retirement age.

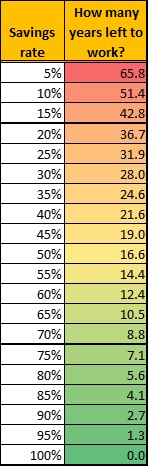

For a simple summary of the concept, have a look at this table, where on the left you see different savings rates ranging from 5% to 100%, and on the right the corresponding time it would take to reach FI/RE.

Following the classic recommended 10% savings rate, it will take you over 50 years to retire (excl. social security and the likes).

On the other hand, you can retire in less than 5 years if you manage a 85% savings rate. This last part sounds amazing, BUT remember, this assumes that you’ll never spend more money in retirement than you did while aggressively saving, forever.

(this table works with the following assumptions, a 5% annual return, a 4% annual withdrawal (explained below) and zero savings to start with – I have a workable spreadsheet available on request)

Being creative on your income side

Another pillar in the FI/RE movement is creating various streams of income to allow for an increased savings rate and also to continue having money come in after you’ve reached the retirement phase.

This can be passive income through dividends (see investing below); by more active means like driving an cab in your spare time or something in between like (self-)publishing (e-)books. The options are almost limitless and can create a personal flavor to anyone’s journey to financial independence. We all have our unique skills that can lead to a special side hustle – perhaps I’ll dive deeper into this in the future. Let me know in the comments below if you’d want to know more. In the meantime, check out some ideas here.

Investing the money in the stock market

Financial independence can be reached by stuffing your money in the bank, but with interests in the historic lows as they are now (in some cases even negative!) it just wouldn’t really help.

That’s why investing your money in the stock market is an important part of the FI/RE movement. Although some might like the gamble, the essence of the FI/RE movement is to invest in low risk, highly diversified index funds, particularly low-cost Exchange-traded funds (ETF).

This leads us to the next crucial tool to reach financial independence which is compound interest.

Making your money work for you

Crucial in speeding up your financial journey is the concept of compound interest, when the money starts working for you.

Simply put, when earning interest on your savings, reinvest the interest and let it bring back interest in its turn. Once you are making interest on interest you will experience the effect of compound interest. Once you’ve reached a certain threshold, your interest will even be greater than the money you can save! Check out the detailed explanation here!

How much money does one need to retire?

In 1994, the world of financial planning was introduced to the 4% rule, now a staple in the FI/RE community which runs with the Trinity study from 1998 showing similar numbers. These numbers translate to the recommended safe withdrawal rate (or SWR, or SAFEMAX), or the amount of your portfolio that you can safely withdraw for that year to spend, without a fear of running out of money. The idea being that your portfolio will always make at least the same annual return leaving the principal at the same level as before the withdrawal. The recommended safe withdrawal rate in the 4% rule is of course 4%.

Bring that the required nest egg before retirement comes down to 25x your annual expenses (in retirement, 4% of course fits 25x into 100%).

Until now, easy math, and the FI/RE movement appears to depend heavily on this simple concept. However, a crucial detail for those retiring early, in the original article the 4% withdrawal guaranteed a 33 year survival of the portfolio. The average retiree at 65 had a life expectancy of another 18 years, so safe enough for the traditional retiree.

However, if you’d retire at 30 – you’d possibly run out of money by the age of 63 (in a bad run). A 3% withdrawal on the other hand guaranteed 50 year or more survival of your portfolio. The 4% also was aimed towards the U.S. the Trinity study showed that for other countries, this might not apply – the Netherlands had a safe withdrawal rate of about 3% to begin with.

Originally, the 4% rule tried to protect investors against rapid currency inflation (not market volatility)- which has been less of an issue compared to the 1970’s where a big part of the numbers are based on. The inventor of the 4% rule therefore has revisited the rule to correct it to max 4.5%, and in October of 2020 again to put it at max 5%. So after all, the 4% rule might actually be considered a safe rule of thumb to use now (if you keep it at 4%). Just be careful of lifestyle inflation in retirement and take any potential wealth tax into account.

Check out if you're saving enough

for retirement with this

FREE DOWNLOAD!

Send download link to:

What is FIRE really about?

Everybody can agree that the pressure in todays society (or any society perhaps) isn’t any fun. The constant feeling of needing to achieve greatness, putting you at risk of burnouts. The social media platforms making you feel like everybody is doing better than you, making you feel like a loser. The increasing amount of uncertainty about the future, will there be a pension, social security – a planet?

I mean, it can get too much – I get it. FI/RE is a way to gain some control – some use it to be able to have a sustainable life and contribute to a better planet, a lot use it to get back control over their retirement or their career by quitting that stupid job that makes you feel stuck.

It is probably also a product of a more individualized society – feeling that you alone are responsible for your future or perhaps feeling abandoned that no one will provide for your future (erosion of the backbone of pensions, social security and the health care system).

Why is it coming up more in the last decades? Well, first world problems, we have less and less real threats in life and thus a ‘movement of the rich’ is focusing on liberating themselves from the biggest threat to their freedom which is a lack of money. And of course, the internet – likeminded people can find each other like never before and create movements and submovements and subsubmovements in a fraction of the time it used to take and makes you feel like you’re not the only one that has these great ambitions and give you some guidance.

Don’t be fooled, the majority of FI/RE are in the affluent category – either coming into inherited wealth, or working in finance, tech, medicine or other high paying careers. There are some variations, such as LEAN FI/RE that seem to be product of those less financially fortunate to also get the idea that they can be part of the fun – albeit with extreme sacrifices – and it would be interesting to find out the actual success rate of those going on the FI/RE journey, not only if they reach their destination but also if they can maintain the desired lifestyle.

Final thoughts

Now, I am not the best example of a personal finance blogger that will push everything with positivity and a can do attitude (nuance rarely sells), but I do I think this is a good movement as long as it creates awareness to people’s financial resilience.

However, many might be deceiving themselves and maybe even putting themselves at risk of having a reduced way of life – as once you leave a career you might not be able to get back into the same level of income when the need arises. I would say, focus on the FI and postpone the RE part, create resilience and the rest will come. All the big FI/RE gurus are in the picture because they are still working, the books you buy and the advertisements on their blogs/YouTube channels keep them ‘retired’.

I am a fan of the concept and the movement, I would just want warn to be careful of the FI/RE Fallacy: Everybody can do this. It just isn’t realistic, no matter how many sacrifices made, for a lot if not most people – life is too expensive (not because of the Lattés) and too unpredictable. As mentioned previously, the average savings rate in the Netherlands is around 2.8%, around 7.5% for the U.S. with the 401(k) construction, which translates to at least 50 years of work until retirement (excl. social security and pensions).

However, if you are in a position to think – I can do this, congratulations! You might be right, probability is that if you are reading this you might have a very decent income. You can feel great about yourself! Just be aware of how special you really are, and remember to give to those less fortunate.

Leave a message below if you’d like me to make you a calculator to find out when you can FI/RE

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?