This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

2021 Update!

The world of personal finance is flooded with beautiful and sometimes (often) complex worksheets – which assume a certain level of expertise in using Microsoft Excel or its equals. This creates a lot of room for error for those less experienced with these kinds of programs and with that a serious bias in who has appropriate access to these ((un)necessary) tools. This is why, instead of creating just another version of the same complicated worksheets – I provide easy-to-use worksheets with limited access to prevent unnecessary (mistaken) modifications.

With this being said, hoping that every sheet can be used without much explanation, I do feel the need to provide access to some sort of manual for each of my worksheets for those still uncomfortable with using them. If after all this, you still have questions or missing something – reach out! info@financialphilosophies.com.

Last side note: I avoid the use of currency, to make any sheet applicable to your local situation – this does mean that you should try to avoid mixing different currencies into one worksheet though! I would love to think Rp 15,000 is the same as € 15,000 – but sadly this is not the case!

“Don’t wait to buy real estate. Buy real estate and wait.”

– Will Rogers

The worksheet – Mortgage Calculator

I spent a lot of my early time on this website explaining the basics of mortgages, as this might be one of the biggest financial decision one can make. A decision that can set you up for a net worth increase while you’re asleep – or put you in a life of worry over paying your monthly bills for years to come. While it might be a discussion on whether or not it is better to buy than rent, it is good to know the numbers associated with your situation to make an informed decision.

With that in mind I made a mortgage calculator, or actually two – an international version for people around the world that applies the principal from Charles Farrell’s Your Money Ratios, and a version that uses all the relevant legal limits for the Netherlands, to give a very accurate indication of your options within the Netherlands (I will try to keep updating it annually as the numbers change).

The dashboard – Dutch or international

As this is perhaps one of the more complicated worksheets, it starts off with an easy decision – are you considering a mortgage in the Netherlands, or anywhere else (international)? Click whichever applies to you and you’ll be taken to your specific worksheet to fill out.

The main difference is that mortgages are very susceptible to local laws (or absence thereof), and using the Dutch version for anywhere outside of the Netherlands would probably not be worth the effort of filling out a lot of information. Language wise it won’t matter; all my material here is English. I will take the Dutch version as an example for the rest of this article, as the International version is the same, but minimalistic in its output.

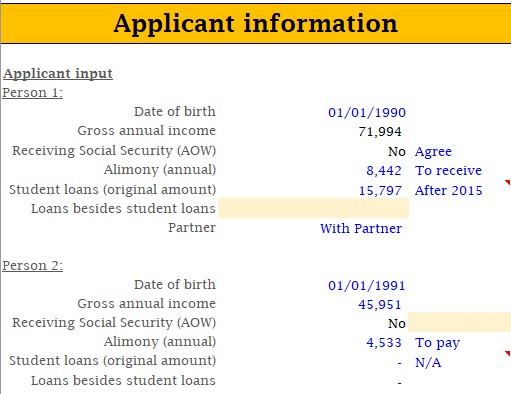

The input – Applicant information

This worksheet has two sides of input, the first is your information, your income and your financial obligations. The last one being debt and alimony, as they will reduce the money available for paying your mortgage. Each golden cell shows you where you can provide input, or you’ll need to make a choice from a dropdown menu. It is always recommended to fill up everything, especially as the lack of input in certain cells will make the worksheet make a choice for you (and it won’t be to your advantage).

You’ll have the option to choose whether to use the information of a single person or a couple buying a home together by choosing between ‘Alone’ or ‘With Partner’ at the bottom option of person 1. Choosing ‘With Partner’ will open up another section to fill out for person 2.

Using the date of birth, the worksheet will calculate whether this person is receiving Dutch Social Security (AOW) – as AOW can be postponed there is an option provided to state whether you ‘Agree’ or ‘Disagree’, the latter changing the automatic calculation to the opposite answer. If nothing is chosen, the worksheet assumes you agree.

If you or your partner have any alimony obligations attached to you, it is important to mention is – but especially also to choose whether you are ‘To receive’ or ‘To pay’ the alimony from the dropdown menu. Alimony will increase or decrease the annual income used to calculate the money available for paying off mortgage obligations and can therefore have a big impact on the amount of money you can borrow.

Student loans carry a special impact in your mortgage calculation, compared to other debts. For this reason it is important to select whether your student loans where taken before or after 2015, as the way they impact your mortgage differ significantly (read here). Together with your gross annual income, your obligations affect your loan-to-income ratio.

When this is all filled out for each applicant, it is off to the house specific input.

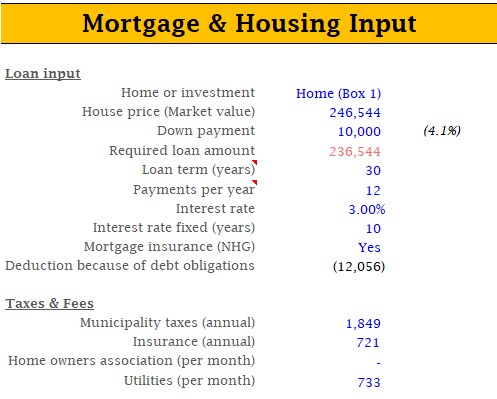

The input – Mortgage & housing input

This section starts off with a multiple choice question in a dropdown menu; is it home or is it an investment? Depending on the answer the mortgage will come in a different tax box (box 1 or box 3, not really important right now). This choice matters as the rules are more favourable for purchasing a home, and it will affect the total amount of loan available to you.

Second, the value of the house you’re looking to buy is essential to determine the loan-to-value ratio, an essential for getting to the mortgage available to you. You can choose to add a down payment; the sheet will give you the percentage of the market value as some extra information. The house price minus the down payment gives you the required amount you’ll need to loan – which, as in the given example, turns red if this is more than you’ll be able to borrow based on your loan-to-income ratio, calculated in the previous section. In that case – pay less for the home, add more down payment or look for another home (unless you can increase your income quick enough).

Next, you’ll need to decide the loan term (in years), without input a 30-year mortgage is chosen, and how many payments per year you’ll be making – standard will be 12 payments (monthly). Finding the current interest rate should be easy using your search engine of choice, if left empty it is set to 5%, and attached to this you’ll need to decide for how long you’ll fix your interest, if below 10 years the interest rate used will be 5% again (I don’t make the rules here). Last part of the loan input is the choice on whether or not to have a mortgage insurance, a Yes/No dropdown option. Your deductions will carry over automatically from your obligations mentioned in the previous section.

Finally, to make a reasonable assumption on your monthly housing expenses there is the section on taxes & fees, which should be easy to find again using your search engine of choice, homeowners’ association fees (if applicable) are usually mentioned with the advertised home. For municipal taxes, I use a rule of thumb of about 0.75% of the house price, in case it isn’t easily found.

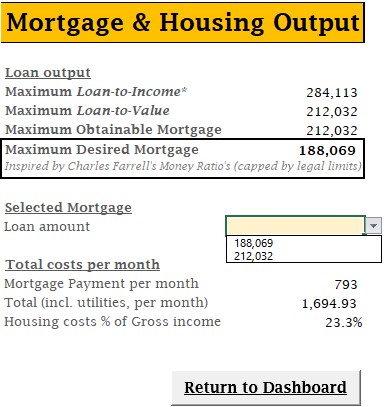

The outcome – Mortgage & housing output

Combining the input provides you with the following outcomes, your maximum loan-to-income (not taking into account that you might retire soon), your maximum loan-to-value – based off the value of the home you wish to purchase. From these two, the lowest will decide your maximum obtainable mortgage loan. As I try to use financial philosophies to get to the best decisions, I also provide maximum desired mortgage, inspired by the Money ratios from Charles Farrell. Ultimately, it is up to you which one you would go with – and you can choose either one using the dropdown menu, which will then give you your mortgage payments per month (base on a level-payment mortgage), your total housing costs per month (incl. all the taxes and other fees), and how much of your gross income is spend on these housing costs. At the bottom, you can find a button to return to the dashboard to choose the other version (The Netherlands or International), pressing this button will delete all your input.

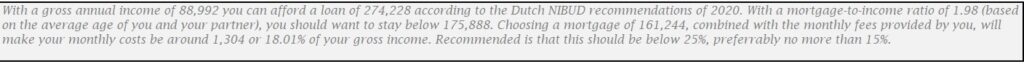

The outcome – Text summary

While you are filling out this form, a text will begin to form at the bottom of the worksheet, explaining the outcome (depending on which version you choose to fill out) – what your loan-to-income is, what your mortgage ratio is based on your age – and what that means for your desired mortgage. What the costs associated with the chosen mortgage amount will be, and what is the recommended amount of your income spent on housing would be.

Have any suggestions for improvement or things that you feel are missing? Let me know in the comments below!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?