This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

How to name your level of wealth? Many people in personal finance speak about financial independence and they tend to focus on the numbers. I’ve talked about the numbers for determining your net worth, and how to check whether or not your wealth building is on track (also check out the free cool downloads to help you with that here & here). But there are many steps along the way, many of which are as admirable to achieve as financial independence. For this article, I wanted to share with you my philosophy on the road to financial independence (and beyond).

“If you are not financially independent by the time you are forty or fifty, it doesn’t mean that you are living in the wrong country or at the wrong time. It simply means that you have the wrong plan.”

– Jim Rohn

Different levels of personal finance

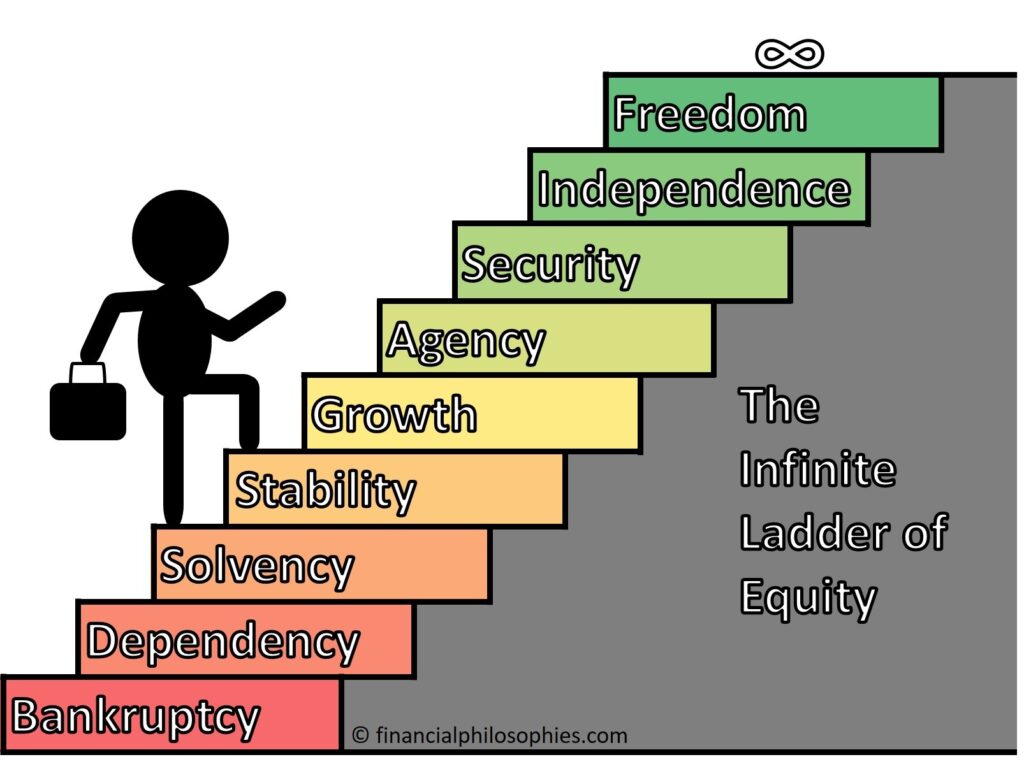

All financial levels are equal, however more are equal than others – financial status exists on a gradient and one will progress up or down with ever coin earned or spent. There are however certain milestones that can carry you along the route and if you keep your head cool, they can form the new plateau from which you can jump to the next level. I have divided the different milestones on The Infinite Ladder of Equity (TILE) as depicted in the figure below.

There are many iterations out on the web on what kind of ‘levels of finance’ exist – some say three, others say ten (or any other number that tends to work well for marketing reasons). I say, there are an infinite amount of levels. I refer to infinity, as both the top and bottom can continue endlessly. There is no limit to how much money you can owe (much more than you own), and there is no limit to how much money you can earn (ignoring the debate on whether or not billionaires should exist). But between the infinite extremes, you can divide into 9 intermediate steps, or as I like to call them TILEs (trying to push the acronym). Let’s dive into the first TILE, dependency.

Financial Dependency

As much opposite to financial independence as you can be, financial dependency is the starting point. We are all born into dependency, requiring our parents to provide for us – you are not making any money, but you are spending it (or costing it).

You can continue here for longer than might be healthy for you, buying on credit – depending on creditors allowing you to buy things you need. One step away from a slide into the negative spiral that can be a start of infinite debt (with bankruptcy being perhaps the best possible solution).

But as a starting point it is beautiful, we have no bills, all we earn or get for an allowance we could just spend without any real repercussions. I think, that this phase of life would be preferred by many, and for those with well-to-do parents, the dangers of economic out-patient care are born here. Reaching financial independence gives one the same freedom from worries – better to continue upwards to the next TILE, don’t you think?

- Risk: Remaining dependent on others indefinitely, which might not be able to support you long enough.

- Opportunity: Early in life, the freedom to experiment, to grow and build some wealth before the bills start coming.

Financial Solvency

Having a job that allows you to live from paycheck-to-paycheck makes you financially solvent, but it is a breakeven point. You can survive here; a lot of people do. One of the dangers that can keep you here is life style inflation. When earning more money means spending more money, you’ll create an infinite spiral of spending – which will not only will affect your fulfilment in life, but it will also keep you trapped in this TILE for your whole working life and perhaps some steps lower in retirement!

Staying at breakeven is a vulnerable position, one mishap like losing your job would bring you down, depending on your expenses even towards bankruptcy. You can survive, but thriving would be easier on a higher TILE.

- Risk: Breaking even is living on a knife’s edge, one mistake and you cannot maintain your current standard of living.

- Opportunity: Resisting the temptation of life style inflation will give you the opportunity to grow beyond the breakeven point and start building your reserves.

Financial Stability

After you have gotten rid of consumer debts (excl. home mortgage), and build up a small emergency fund, you can start to reach stability and slowly grow. For those into the Dave Ramsey philosophies this TILE would be similar to his baby step 3.

Some say that financial growth can only be achieved after getting rid of your mortgage, where all your money can go work for you, but I believe that a mortgage would not prevent you from growing financially – depending on your interest rate, it might even be better to keep it as leverage.

- Risk: An small emergency fund won’t last forever; the main risk in this stage is depleting your savings without opportunity to rebuild it.

- Opportunity: With the small emergency fund in place, you can start building resilience into your financial plan by expanding your emergency fund to a level you’re comfortable with (3 months of expenses is considered a minimum, some go as far as 12 – 18 months).

Financial Agency

With an emergency fund on hand, your money can be used to buy assets that can increase in value (stocks, bonds, real estate etc.) which will allow you to build wealth, over time.

When you start building wealth you gain agency. You are no longer fighting hard to drop to lower TILEs, but instead you’re gearing towards moving upwards. You are not in the safe zone yet, but you’re getting there!

In this phase, you’ll probably have the money available to pay off your mortgage (if you wanted to), but I still feel the opportunity costs should gear you towards not making being mortgage-free a priority.

- Risk: Taking too much risks with investing. Risking it all to get to the next TILE sooner is not a wise strategy – you might be able to afford losing the money, but those risks will prevent you from moving up.

- Opportunity: With the emergency fund in place, you can start allocating money for investing to really start growing your net worth.

Financial Poverty

Just to remind you, that at any step along the way it is possible to slip down the ladder and end up in a debt-controlled life – summarized here as financial poverty – of which bankruptcy might be the better evil, but it can reach into infinite debt.

There is no shame in staying in one step longer than another, not even in dropping a step every now and then – the importance is to keep in control!

- Risk: Losing control, taking too much risk at the stock market, risking to quit your job when you’re not ready for it, risking leveraging debt to finance a life style choice. It can take many forms, but it just needs one big mistake (or several small ones).

- Opportunity: Awareness creates prevention!

“The more you earn, the more you spend “

– Parkinson’s law

Financial Security

This stage is considered by some as the first stage of financial independence – however this is the survival mode – you can maintain a minimum standard of living. This is the TILE where you’ve earned your freedom from your job – you can choose another job independent of salary or hours worked, or not work at all if your happy to life on a budget

- Risk: Retiring too early, or not being honest with yourself on what kind of budget you can survive – putting you back into a career that you’ve just said goodbye to (which is harder than you might think).

- Opportunity: Plenty of opportunity to keep earning money at a level that you might not need any more to keep the gears running you up the ladder.

Financial Independence

The long awaited Financial Independence! When you have reached this step you can maintain your current standard of living – a common rule of thumb in the personal finance world is your annual salary x25. Allowing a 4% withdrawal rate – although it is a bit outdated for the 21st century (and U.S. centric – for the Netherlands use ~3%, meaning you’d need 30-35x your annual salary). This is where you’ll find Freedom from employment – losing a job would ‘never’ (never say never) hurt you again; there is always more money coming in (or you’re going to die soon, depending on how long it took to get here).

- Risk: What do you mean risk? This is the goal!? Well having a lot of money can feel empty without purpose – many financially independents choose to maintain some form of employment or entrepreneurship. Be sure to know what to do with your life once you’ve reached this level. Sitting on the beach drinking cocktails all day everyday probably won’t entertain forever.

- Opportunity: From this place of abundance, you practically can’t give away the money fast enough. Although for many charity is intrinsic at any level of financial wealth, here you really have the space and power to give wholeheartedly.

Financial Freedom

You can never be too rich – becoming a financial independence rock star can give you a lot more than needed to provide a standard life style – as it is said it is an infinite ladder – someone with 2 million is not the same kind of rich as someone with 1 billion after all.

- Risk: Not spending enough money. You’re there – yes, you can get to the next level and the next, but what’s the purpose if you aren’t enjoying your money?

- Opportunity: Freedom, do whatever you want (within legal limits). What’s stopping you?

How to reach the next step?

Personal finance has a danger in the assumption that all opportunities are equal and responsibility lies solely with those that wish to reap the benefits. This is certainly not the case, so don’t worry if this section provides impossible action points for you right now, fight one battle at the time.

Assuming that there is economic justice in your life, and yet you still have not been able to reach the next step – what can you do?

- Focus on getting rid of debts

- Increase your savings rate

- Decrease your expectations for retirement

- (study with me to learn more!)

Final thoughts

Although it is tempting to relate theses TILEs directly to your net worth, as some will do, it is actually more of a reflection of your cash flow (how much coming in vs. going out) and the effort that needs to put into achieving that cash flow on a daily basis (so ladder of equity might not be the best name yet, suggest a better name below!).

For example: my son can have some money in his piggy bank, and he has zero bills to pay – his net worth is definitely positive, but he is as dependent as can be. Conversely, someone with a house ‘under water’ with a negative net worth, but a steady job can arguably still reach Financial Stability.

This ladder of equity has a lot in common with the fulfilment curve, from the book the book ‘Your money or your life’ I talked about previously, the first half where spending increases with increased income (probably) and eventually you will get to a point of ENOUGH. Financial freedom continues into more fulfilment following what the book ‘Your money or your life’ describes as going from GETTING more to GIVING more – leading to infinite increase of fulfilment. The main difference – you don’t need financial freedom for ENOUGH (a good note to end on).

Do YOU need to reach full financial independence? What step would you feel comfortable with to stay on forever? Are you getting there?

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 14

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?