This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

Ever wondered why you need to keep paying for 30 years for a house you supposedly own? More and more people are wondering the same and have started paying off their mortgages early to live a mortgage-free life. Are lower monthly payments the holy grail and should everyone just pay off their mortgage as soon as possible? You guessed it, probably not, let’s have a look at pre-paying your mortgage.

While a lot of what will be mentioned here is applicable regardless of mortgage types, there are definitely exceptions for the more ‘exotic’ mortgages (especially the savings-based mortgage). Therefore, assume that I will be talking from the amortized mortgage perspective.

“Debt is like any other trap, easy enough to get into,

but hard enough to get out of.”– Henry Wheeler Shaw

When NOT to pre-pay your mortgage

While guru’s like Dave Ramsey and a multitude of (Dutch) financial influencers push for getting rid of your mortgage debt as soon as possible, let’s start with the moments when NOT to pre-pay and the downsides to doing so.

When should you not pre-pay your mortgage, and why? Firstly – do not – I repeat – do not – forego a financial buffer in order to pre-pay your mortgage. This money cannot be recovered once it is turned into bricks (without severe side effects). Be sure to spend only money that can be missed for perhaps 30 years or better yet, forever (who knows). Extra mortgage payments should be done with spare change. Even Dave Ramsey puts the mortgage after not one, but two baby steps regarding financial buffers. If even one of the biggest anti-debt gurus out there says it is better to have this debt than not having a financial buffer, you know it must be important. Maintaining a certain level of liquidity is essential.

Second, if your mortgage interest rates are lower than the average rate of return in the stock market, it is not considered a good time to use (all) your spare change to pay off the mortgage. Instead, investing would give a higher benefit over the same duration as your mortgage (i.e. 3% annual mortgage saved for 20 years vs. 7% average annual market return for 20 years is a difference of 4.5x the money saved after 20 years). This is what is called an opportunity cost – you can only spend your money once – choose the one where the better return is found. Stock market returns are of course not predictable – be aware of this! If you have other debt, with higher interest rates (i.e. credit card with a rate of 12%)– these should definitely come first – as these returns are guaranteed!

An added level of complexity in the time value of money is inflation. While this is too much detail to explain here, think of it like this; people that had a mortgage in 1950, still paid the 1950 price of their house in 1970 (for a 30-year mortgage). Average house price in the U.S. in 1950; $7,354, in 1970; $17,000 (or 2.3x more, similar number in the Netherlands). While inflation eats away the buying power of your currency over time, your mortgage payments will not inflate with them. As a result, any pre-payment 20 years early will cost you more buying power than if you’d paid it 20 years later. Depending on the interest you’re saving by pre-paying, this might matter a lot (or not).

Your mortgage provider will not appreciate the loss of interest payments due to your pre-payments – inform yourself first if your lender upholds any fine for pre-paying. In the Netherlands, usually you can pay at least 10% of the original loan penalty-free per year. This might vary per country and per mortgage provider. While this is not a reason per se to stop you from pre-paying – it is good to consider spreading it out, if the penalties would outweigh the benefits.

What many people will hear in this discussion is that pre-paying your mortgage will reduce your tax benefits – this is a fallacy. Consider it like this, let’s say you pay 1.00 in interest in a given year and your tax return for this amount is 0.60 – that tax return seems awesome, but remember you still paid 0.40 in interest nett. Now let’s say you’ve paid off your mortgage early and paid only 0.80 in interest, your tax return now is only 0.48 – feels less awesome, BUT now you’ve only paid a nett interest of 0.32. Yes, your tax benefit is reduced – but it was your money anyway, so why not pay less in the first place?

Now for the Dutch situation and possibly other countries there are some other things to consider here that would be a potential pain, depending on your income level. The mortgage interest deductible works by deducting your mortgage interest from your gross income used to calculate your income taxes. When reducing your mortgage interest payments, you indirectly increase your taxable income. This is important for two reasons – one is that your income might be taxed at a higher rate than previously, the other is that your social benefits (Dutch ‘toeslagen’) depend on your taxable gross income – if your income previously qualified you to get social benefits, for instance financial aid for health insurance, increasing your taxable income might exclude you from this financial aid entirely.

Lastly, for the Dutch there is the regulation that ‘profits’ from the sale of your home need to be put into the next home (Dutch ‘Bijleenregel’). This refers to difference between the remaining debt and the equity in your home. Example: you sell your home for 200.000 and your remaining mortgage is 150.000 – your ‘profit’ of 50.000 needs to be put into the next home (regardless whether you bought the house for 500.000 – it is still considered a profit). If you don’t do this and you buy a home with a mortgage within 3 years of sale, this mortgage will lose eligibility for the mortgage interest deductible for the unused profit (making your nett mortgage more expensive). After 3 years this rule no longer applies – this stacks, so each home sold will have a ‘profit’ to take into account for three years after sale. In case you would want to wait three years, don’t forget the profits after sale will be counted as part of your net worth and might be taxed accordingly starting at the year of sale.

When to consider pre-paying your mortgage

Let’s keep it simple – the main reason to pre-pay your mortgage for most people is the lower monthly payments and the sense of security of being completely debt free. Peace of mind is also very valuable and might be worth the sacrifice.

Converse to the previous section – if you have a mortgage interest rate similar to that of a credit card rate like 12% or higher it will be interesting to get that out of the way – instead of putting it into the stock market or anything that brings lower returns. Another situation, perhaps more likely for a lot of people – if you aren’t actually going to take the money you’ll save and invest it somewhere where it’ll make money – it might be better to pay off your mortgage. But again – keep the financial buffer!

Depending on your mortgage type and mortgage insurance, having less mortgage debt might allow your mortgage interest to decrease, due to a lower risk for the mortgage lender. Lastly, for those that have to worry about a wealth tax, in the Netherlands the equity put in the home is not taxed as wealth (the home is taxed on the hypothetical home value) – so putting more cash into your home will shield it from the (Dutch) wealth tax.

7 steps to get you to pay off your mortgage early

If you are still inspired to get rid of your mortgage early – how to go about it?

- Educate yourself on the potential downsides, see above, this really is on you and no one else. Enquire with a mortgage adviser if you’re not sure.

- Make sure you have enough financial buffers – depending on your risk tolerance usually about 3 to 6 months of your expenses are recommended, some even go to 9 or 12 months.

- Start with getting an accurate feel of the situation, how much money is left to pay, how many years left to pay (the type(s) of mortgage, as each type might need you to take different approaches).

- Find out if your mortgage lender requires you to pay penalty fees and how much you can pay penalty free (usually 10-20% of the original loan per year).

- Find out how you can process the extra payment, wire transfer, online automatic payments.

- Find out which strategy you want to use to pay off – see below.

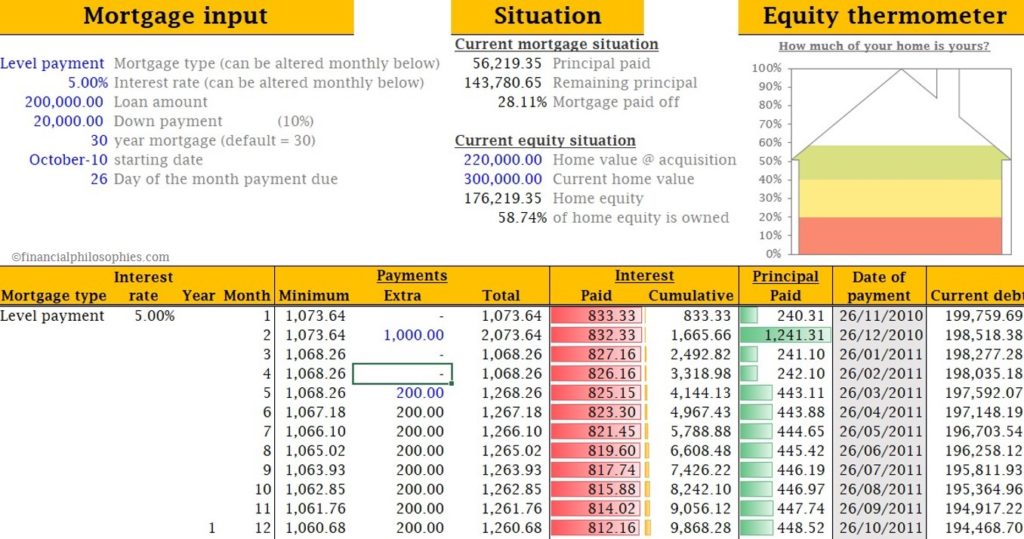

- Start! Visualize your progress to keep yourself motivated to keep going! (see image)

7 Strategies to pre-pay your mortgage

The kind of strategy would be best to pre-pay your mortgage really depends on your personal situation and the stability of your income. Let’s start with the basic assumption that you at least make the normal (minimum) payments monthly – and you’ve taken care of any other high(er) interest rate debt. 7 strategies that can be applied (in random order) are:

- Add a fixed additional amount on top of the normal payments.

- Round up the normal payments to the nearest 100.

- Making bi-weekly payments, meaning pay half the mortgage every two weeks instead of once a month in full (alternatively make 13 instead of 12 monthly payments per year).

- Increase your mortgage payments with each salary increase (2% increase in salary means 2% increase in mortgage payments).

- Add one-time windfalls to your mortgage payments (i.e. holiday bonus, tax-refund).

- Making a bulk payment at the end of the year (especially convenient if you wish to avoid a wealth tax, see above).

- Any combination – i.e. pay 300 per month extra AND put in your holiday bonus AND/OR pay off an additional 5000 at the end of the year.

Next to targeting to get rid of your mortgage as soon as possible, you can also use these strategies to reach a certain target, like being mortgage free by the age of 50.

Use my amortization schedule with pre-payment calculator to find out what each strategy could mean for your mortgage.

4 reasons to pay off your mortgage early

Coming close to the end of our journey, let’s summarize the main reasons to consider whether or not to pre-pay your mortgage.

- Pay off your mortgage if you want to have lower monthly obligations, or you’re allergic to having any kind of debt (preferably penalty free).

- Also consider paying off your mortgage if this is the best return you can get with your personal risk tolerance, money in the bank will lose against inflation. If you’re not going to invest it, might as well consider using it here.

- Alternatively, you can consider to pay off your mortgage to avoid a wealth tax (if this is something that can apply to you).

- Lastly, putting extra money towards your home can be part of your overall investment strategy as well – balancing it out against the risk of the stock market.

Pre-paying the mortgage – going Dutch

Some final remarks for those active in the Netherlandse. When trying to find Dutch literature around personal finance, most likely, the first thing you will find are people suggesting to get rid of your mortgage ASAP. Think about books like “Hypotheekvrij!” (Dutch for ‘Mortgage free!’) by Gerhard Hormann (or his 2020 looking back on the journey “Eindelijk hypotheekvrij!”, Dutch for ‘Finally mortgage free!’), or “Eigenwijs je hypotheek aflossen” (Dutch for ‘Stubbornly paying off your mortgage!’) by Marieke Henselmans. But also popular Dutch bloggers make this the central point of their financial philosophy. Born out of a fear to return to the housing crisis of 2008, is this still a relevant opinion in the Netherlands?

Before jumping into pre-paying your mortgage, you’ll have to realise that a lot of the Dutch promotors of pre-paying your mortgage have a mortgage from a different time than you might have, if you’ve recently purchased a home. The story of Gerhard Hormann is seemingly inspiring for many, probably due to the timing of his publication (around the economic recession). But mortgages have changed significantly, with changes in the amount you can borrow, changes in the tax-breaks – pushing for mortgages types like straight-line and level-payment over the previously popular interest-only mortgage (which is the type of mortgage Gerhard Hormann’s book is applicable to). Unless you’ve got a mortgage predating 2013, their advice might not apply to you at all!

The Dutch are overall a debt shy people – but they can overdo it – do your due diligence before following the fad.

To pre-pay or not to pre-pay? Which camp are you siding with? Tell me why!? Let’s get the discussion going!

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?