This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

With the lessons learned the last couple of weeks, I decided to look back to my story of becoming a homeowner and reflect whether I would still do the same or if I would do something different right now?

“The only time you should ever look back is to see how far you’ve come.”

What lead to our home purchase?

The simple reason was, that we were tired of paying too much rent without getting so little in return. That’s why we decided to look into buying instead of renting. Next to this we were planning to get married and we would like some more space to live together, it felt was the right time to consider this option. But with both of us in a career that might bring us anywhere in the world (twice) we had no real idea how long we would settle (or where) – all we knew was that we would be contractually obliged to stay at least another 2 to 3 years at our current location. We were (or at least, I definitely was) blanc in the world of finance, especially the idea of purchasing a home. But we learned quite soon that it wouldn’t be wise to buy a home without being willing to spend at least 5 years there – but we decided to take the leap anyway. Within 2 years though, I decided to fly off to the U.S. but luckily didn’t sell the house on a whim! Because, I was back after a year. However, did this house now tie me to a city, away from where the best career opportunities would be? Would I do the same with what we’ve learned so far about the wonderful world of mortgages?

What decisions did we make?

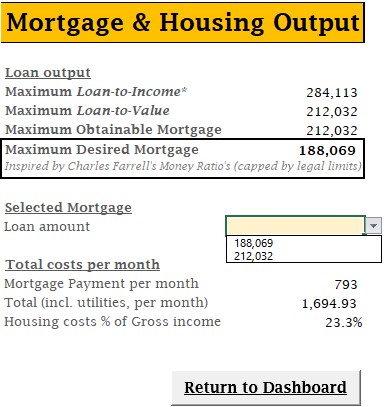

Let’s start at the beginning, what decisions we made, after the initial decision to purchase a home (and which one). At the time, I believe, the maximum loan-to-value was about 104% of the market price and we just took what we could get, although I am not sure what our maximum loan-to-income was at the time, I am sure we didn’t try to get to the max on that side – the market was just coming off its lowest point, so we’re talking prices that are no longer available even for small apartments. We just wanted enough, not the max we could get. What did we know, at the time (or now for that matter)? We didn’t really save for any down payment as we had a wedding to finance after all (not a father-of-the-bride pays kind of culture). I had only been working for a few years at this time, my wife-to-be just finished her first year of working (in this country) – so there wasn’t all that much money left to begin with, so to be honest, I was surprised we could do anything to start with!

As I mentioned in a previous article, we just wanted something a little bit bigger to live in, nothing extraordinary, just tired of paying every month without building equity. Our financial advisor (the first one I ever spoke to, to be honest), suggested we should think bigger than what we were thinking at the time – and I do believe he thought he was doing us a favor. His arguments of not wanting to pay too often to upgrade, if we were already sure there might be kids in the near future for instance. At that time, it was already not allowed for financial advisors to earn commissions on selling a mortgage – so there wasn’t any incentive for him to sell us something we didn’t need. Luckily these regulations of the financial world were in place, because I would not at that time have thought about financial advisors NOT working in your benefit (which is apparently the norm in the U.S. – where the word ‘regulations’ is a curse word). I would have been too naïve to handle that kind of world at the time (and probably still).

Again, ignorant in the world of finance and mortgages specifically, we relied heavily on our financial advisor to recommend the proper type of mortgage. With the tax breaks for interest-only mortgages recently being halted at the time, there really wasn’t all that much to decide though – and with the majority of homeowners, especially starters, taking the level-payment mortgage this would also be the logical recommendation – and we did like the idea of predictability in our mortgage payments. Similarly, most starters take a 10-year fixed interest rate, again, not a controversial recommendation to receive and we took it. Although, I remember an older colleague at the time telling me that they had never regretted to not fix their interest rate – after they had fixed it for 10 years at a double digit interest rate. Hindsight being 20/20, this would have been beneficial for us mathematically – but even at that time people were ‘sure’ the interest rate could never go any lower (it kept dropping for another 6 years or so). It all depends on your risk profile, and ours was not that high at the time (still moderate). To have manageable mortgage payments, besides the level-payment mortgage we also opted for the recommended, and by far the most common, 30-year mortgage with a mortgage insurance (NHG) to get ourselves into the lowest interest rate band.

With that we’ve discussed all the decisions made basically all at once under the guidance of a financial advisor. Years later, I would take the leap to make some extra mortgage payments – to get into the mood of financial freedom, doing something that paid more than 0.01% interest (yes, for those U.S. readers, most Dutch banks really have interest rate in this range at the moment – at that time still a bit more but still probably no higher than 0.05%). Prepayments, I would consider part of my early investment portfolio – low, but guaranteed returns.

Would I do it differently today?

Using the monthly cost of ownership formula, buying a house was no brainer, with the added addition of equity building it still feels like a good decision. However, more and more maintenance is popping up, and I am more of a cerebral person than a handyman – so that’s perhaps a downer to me personally, especially with the prices to be paid for things like a heavily needed bathroom renovation. Taken together I still think that homeownership was a good decision, but I wouldn’t mind renting again– providing me with more freedom to pack up and leave when opportunity knocks.

Getting a mortgage 104% of the home market value would of course not be possible today, and to be realistic, I would not have been able to purchase my current home without that leverage. So I would still probably take the maximum mortgage I can take, especially with the opportunity cost attached to tying up too much cash in a down payment. The 10-year fixed interest rate, did not work in our benefit – but I would still do the same, as it is easy to say you would buy Apple stocks 20 years ago – but you won’t recognize the new best thing to happen right under your nose at this very moment. The mortgage insurance really is a no-brainer and I would definitely get it again, as the costs were limited with a continuing benefit to reduce my interest rate for as long as I keep this mortgage. Similarly, the accompanying life insurance that was required will give us some buffer if one of us might be taken to soon. Although, as it is an insurance that decreases over time, I am uncertain how much we would get – but I hope we’ll never have to find out.

The mortgage types, I must admit I probably did not understand properly at the time, looking only at the monthly payments (like most people might). Looking back, I might consider taking the straight-line mortgage – although our income was not too great at the time, it would allow to build up a bit more equity early on – especially as I was not comfortable with investing at the time, it was my main source of equity building at the time. As it has been a main source of equity building, I also don’t disagree with my pre-payments on my mortgage – but I might reconsider doing too much of it in the future as the opportunity cost is real, but in that context, I have also experienced already a few major dips in the short time that I have been investing – the certainty of the gains made with the pre-payments are also enjoyable. Following the same logic, taking a 15-year mortgage instead of a 30-year mortgage would have provided also an opportunity cost similar to prepaying (as you are basically prepaying for 15 years). So I am quite happy to stay with a 30-year mortgage – who knows how long I will stay in this house, probably neither 15- nor 30 years anyway!

All in all, either by accident, or due to a wonderful financial advisor (although he really just gave the advice to follow the majority), a lot of decisions we made turn out to be good enough, not perfect – but good enough. There really was no way of knowing which way the interest rates would go and going for a lower monthly payment was probably the better thing to do at the time.

Would you be willing to share your mortgage story? What decisions did you make and why, do you still agree with them today? Contact me at info@financialphilosophies.com to get your (anonymous) story published!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?