This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

Do you know that there are different types of mortgages? Can you name them and explain their differences? Buying a house, for many a staple of adulthood – and increasingly for young adults a seemingly impossible dream. Whether or not it is easy to buy a house, reality for most will be that they need help in the form of a mortgage. Let’s start with exploring the basic types of mortgages.

Owning a home is a keystone of wealth… both financial affluence and emotional security.”

–Suze Orman

Mortgage basics

This article is part of a series on the basic variables important in a mortgage:

- Loan amount

- Loan term

- Mortgage types

- Fixing the interest rates

- Tax benefits

- Mortgage insurance

- Other obligations (loans, alimony)

I will of course attempt to include as many different financial philosophies along the way, although this is a topic where I cannot avoid regional specificity when it concerns rules and regulations that apply to various parts of this discussion.

However, as the majority literature references the U.S. situation, I will balance this with providing the U.S. situation next to the Dutch situation (to the best of my capacity). Hopefully you can enjoy and learn a lot during the way – I know I will!

Mortgage types

Amortized mortgage

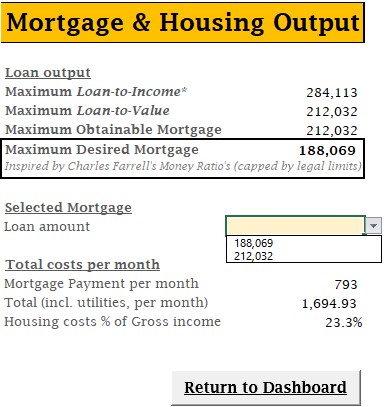

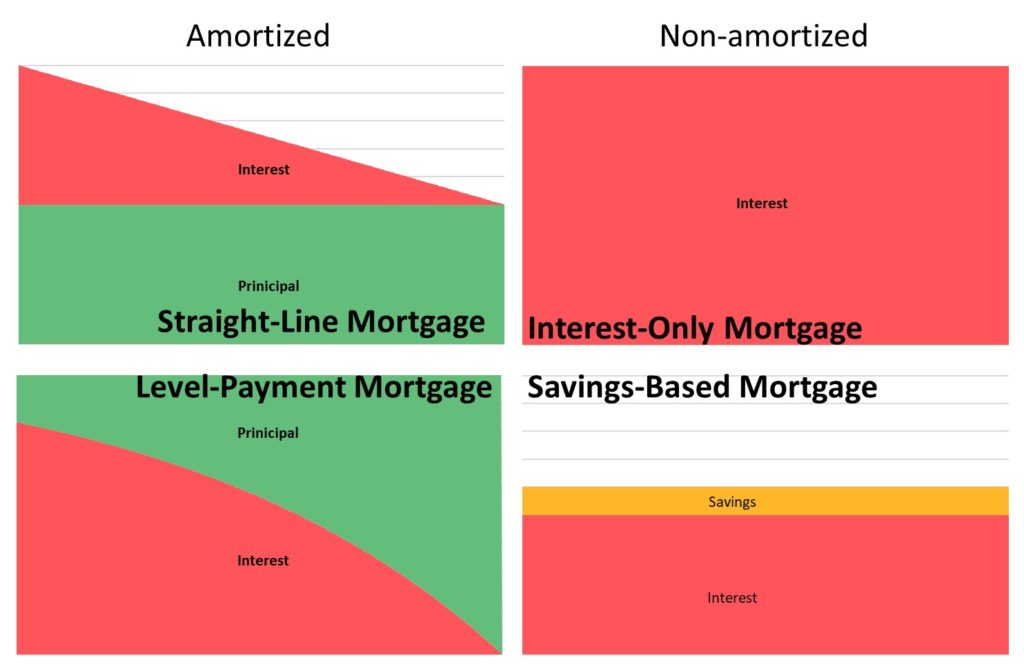

Let’s introduce the types of mortgage one can find in the Netherlands for a house to live in (excluding rental properties). I will try to use American terms to describe them, but be aware that they might not be synonymous to the American equivalent. Let’s begin with the currently main two types of amortized mortgages, the level payment mortgage (‘annuïteitenhypotheek’ in Dutch) and the straight-line mortgage (‘lineaire hypotheek’ in Dutch). Both will be paid off in full after the original term has passed – since 2013 a maximum of 30 years.

The main difference being that with the level payment mortgage, as the name suggests, the monthly payment stays equal – starting out with a lower payment of principal and a monthly decreasing interest payment (leading to an increasing payment of principal to keep the monthly payment equal).

With the straight-line mortgage, the principal payment stays equal, with a decreasing monthly interest payment, leading to a decreasing monthly payment.

In comparison, the level payment mortgage is usually more interesting for first time buyers, as the monthly payments start at a lower amount – however the overall interest paid over the mortgage during the total life time of the loan is less for the straight-line mortgage. The second option would therefore be a more viable option, economically, if you can afford it. Usually people tend to earn more money only later in life and the first option would probably be more viable, practically, at an earlier age.

For example, let’s say we want a mortgage for 200.000 and we can get it at a 3.00% interest rate, and for the sake of the example this rate will be fixed for the life time of 30 years. The straight-line mortgage would start with a monthly payment of 1,054.17, compared to a monthly payment of 843.21 for the level payment mortgage. It would take about 13.5 years before the monthly payments of the straight-line mortgage would be lower than 843.21. However, after 30 years the straight-line mortgage would have paid a total of 90,249.28 in interest, compared to 103,554.69 for the level payment mortgage, a difference of 13,305.41 just by picking a different type of mortgage.

However, take into that the differences between the two variants almost disappear with the low interest rates currently found in the Netherlands, with for example a 1% interest rate the total difference in interest payments amounts to only 1,497.33.

Non-amortized mortgage

Then there is a non-amortized interest-only mortgage (‘aflossingvrij’ in Dutch), in which you don’t pay off any principal during the term of the loan, only interest – with a voluntary payment to the principal. The idea is that the house value will increase over time and then the sale of the house is used to pay off the debt in one go. Variations of this are a savings-based mortgage (‘(bank)spaarhypotheek’ in Dutch), where part of your monthly payment is set to a blocked savings account with an interest rate equal to the rate of your mortgage – which will be used to pay off the mortgage at the end of the term. Similarly, there is the investment mortgage (‘beleggingshypotheek’ in Dutch), where instead of a blocked savings account it is put to a blocked investment account – with the risk and opportunities of the market attached to it. Added benefit is that these blocked accounts are tax sheltered during the build-up, as the Dutch have a wealth tax to deal with. Hybrid mortgages – a combination of the latter two – can also be constructed, depending on your risk tolerance. There are few other options, but the main principle stays the same.

These interest-only mortgages were very popular before the housing bubble collapsed,, due to lower costs and certain tax benefits. After the crisis that caused many people to be financially hurt trying to sell a house worth less than the (unpaid) mortgage attached to it – the Dutch government made the interest-only mortgages less appealing by creating it mandatory to make monthly payments to the principal in order to be eligible for any tax benefit, in addition to a maximum term to pay off the principal of 30 years. This new situation applies to any mortgage started in 2013 or after, older mortgages can still benefit from the old situation.

What do you think is the most important factor to consider in choosing a mortgage type? The height monthly payments? The total interest paid? Maximum tax benefits? Or do you have some other consideration?

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?