This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

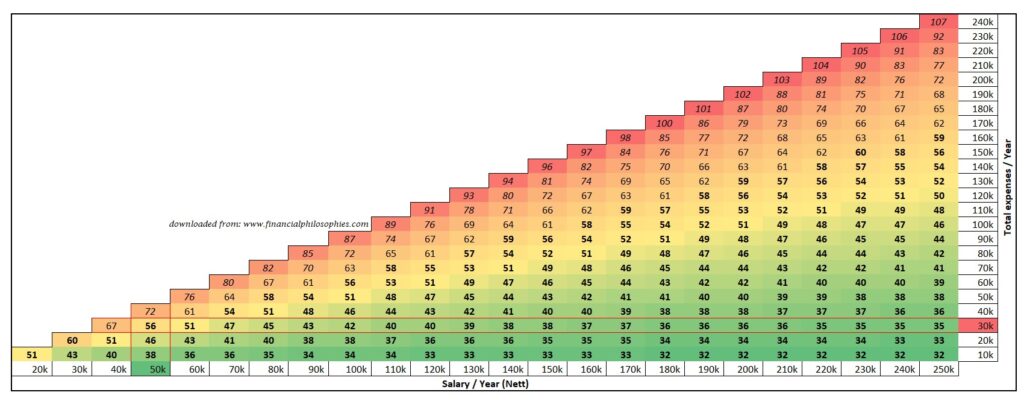

What would it take for you to quit your job right now? Or in five years from now? While I’ve talked about the recommended budget one should keep, which included a 20% for savings. People eager to retire as early as possible have noted that opting to increase this savings rate as high as possible will exponentially hasten your moment to quit that job. With that in mind, I thought to have a look at the math behind the savings rate and why you may or may not be willing to maximize it.

“If you are spending 100% (or more) of your income, you will never be prepared to retire”

– Peter “Mr. Money Mustache” Adeney

Savings rate, what is it?

Popularized in the pop culture of personal finance by Mr. Money Mustache, savings rate is actually not a well-defined term. With many using various ways to calculate it, with sometimes confusing discussions when one is trying to compare themselves to others. So let’s start there.

A savings rate is personal, not saying you can’t or shouldn’t share it – be my guest to share yours below. BUT the key lies in comparing yourself with where you were yesterday, not where someone else is today. Just like getting to know your personal net worth, your savings rate is to show your personal progress in improving your budget, reducing your mortgage payments, or perhaps realizing that with spending less you still have enough.

And then there are all the variations that can make it near impossible to compare anyway. IF you wish to look at a savings rate and put it into a context, let’s have a look at some of the variations one can make.

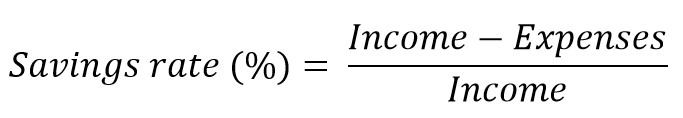

While, the basic formula of a savings rate seems simple enough:

The difficulty lies in the definition of the two variables in question. So let’s dive into the two variables and find out how difficult it can be – and which is better?

Check out if you're saving enough

for retirement with this

FREE DOWNLOAD!

Send download link to:

Income

I have to be honest here, as I was writing this up – I did not agree with the majority and had already written quite a bit on why it shouldn’t just be Nett Income. However, reflecting on the arguments, I have come to the conclusion that yes – it is best to use your net income.

Whereas Gross Income is most commonly used in almost every personal finance calculation, whether it is to determine your expected net worth or deciding how much mortgage you should get. The difficulty lies in that most people don’t really know how much income taxes are part of their expenses, and by taking the net income taxes are automatically subtracted already.

One benefit of using gross over nett income that remains is that it could encourage you to take the most benefit of tax benefits, to reduce these expenses – but I would hope that the tax return is still plenty of incentive.

Expenses

Let’s continue on what counts as expenses and what is saving? It sounds easy, and many also say that income and expenses are ‘intuitive’ and ‘easy numbers’, but as you might guess it really isn’t that straight-forward.

Take for example, your mortgage payments, while it is clear that paying rent is an expense, your mortgage payments (depending on the type) include a principal payment to reduce your loan – in essence transferring wealth from your bank account into bricks while keeping it part of your net worth. Extra payments to pay off your mortgage sooner are easy to see as a voluntary saving strategy – but would you (should you) separate your monthly mortgage payments in interest (expense) and principal (saving)? I don’t feel that mortgage payments are a retirement savings strategy at all, unless you’re intending to sell the house to access the equity, so perhaps it is down to personal preference. It is easier to take the whole mortgage payment as an expense – you don’t really have an option to pay in full or not after all.

Another questionable expense, saving money for a car or a down payment for a home. You are ‘saving’, but are you SAVING? Or is it in fact just a postponed expense? This money is not available to you for growth opportunities in the stock market or something similar, it has basically been spent except for that it hasn’t left your bank account yet. Would it be fair to say that you’ve ‘saved’ this money? Well I would say, yes – as it is going to even out again once it has been spent. This also comes back in the next section, but savings rates like net worth values come and go in waves – not straight lines. While it might ‘inflate’ your savings rate at one moment, as soon as it has actually left your bank account your savings rate will equally ‘deflate’ at the next moment – causing your average savings rate to eventually even out.

Hard-core fans of savings rates might start to point out at this point that they use savings rates purely to indicate the growth of their nest egg for retirement and thus usually not including postponed expenses as savings. Here lies perhaps the biggest issue for the savings rate for countries that rely heavily on pensions. In the U.S. contributions to a 401(k)/403(b)/Roth or other individual retirement accounts are commonly added to the column of saving (and thus subtracted from the expenses). However, when looking at pension contributions, it becomes a very difficult, if not impossible, task to determine how this add up to your savings rate as your personal contribution does not relate very well to the actual amount of saving (even ignoring the taxes that will come later). With the current pension system being as it is in the Netherlands, I would, as does almost every Dutch personal finance ‘expert’ not even bother with adding this to your savings rate.

In defence of this standpoint, no one ever seems to add build-up of social security (‘AOW’ in the Netherlands, 2% per year) to their savings rate – whereas it is growth added to your retirement balance. My point being perhaps, that savings rate should not just be about retirement nest eggs – it should be about encouraging positive saving behaviour (and budgeting for postponed expenses is positive).

As it is easier to state what isn’t an expense, let’s summarize what would be seen as savings instead of an expense:

- Additions to savings account (including postponed expenses)

- Investments (outside of retirement accounts)

- Individual retirement contributions (excl. pension or social security)

- Extra mortgage payments

- Principal payment part of mortgage payment (personal preference)

Check out if you're saving enough

for retirement with this

FREE DOWNLOAD!

Send download link to:

Frequency

Now for the last part of the discussion on savings rate, let’s briefly talk about frequency. How many times should you look at your savings rate? Is there such a thing as too much? Well, yes and no. A savings rate, like net worth, can vary widely month to month, so it should be only an annual number. However, if you are willing to see how badly your savings rate can fluctuate over time – and your using a nice worksheet to track your finances – there is nothing against having a month to month overview of your savings rate. Just don’t average your monthly savings rate to get an annual rate!

Final thoughts

Now should you max out your savings rate – compete with yourself or others to retire as soon as possible? Well, no – it isn’t recommended. Extreme saving creates suffering now – with a probable suffering later. You cannot postpone enjoyment in life indefinitely in order to have a hypothetical better life later – especially as most retire early movements focus on maintaining the pre-retirement life style (using the amount you spend now; to predict what you need later). Which in itself forces you to spend little on enjoyment also after retirement (and continue suffering).

What’s the point of saving money if you’re not enjoying it!? Don’t just work for those that stand to inherit your wealth when you’re gone – they would want you to have a good life also. Have some coffee dates – go visit parties – you shouldn’t need to life a deprived life now only to retire ASAP without any friends left.

In the Netherlands, the last couple of years, the savings rate in the Netherlands has hovered around 2.8% (according to CPB). If you can manage the 10-20% savings in your budget as suggested earlier, you’re already doing a whole lot better than average. Don’t forget that it is the journey that counts, not just the destination.

What is a savings rate for you? Is it only the long-term saving or do you take into account any bit of saving that you can get?

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 16

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?