This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

When the money is gone, is there still month left over? Stop running out of money before the end of the month with good budgeting strategies. Hate budgeting? I’ll talk about anti-budgeting as an alternative – let’s dive into the wonderful world of budgeting.

Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are

– James W. Frick

Are you anti-budgeting?

Budgets suck! They take too much time, they restrict me too much, they are confronting me too much about my terrible spending patterns, it is just too much to bare! Say no more, anti-budgeting has got you covered!

There are many processes floating around named anti-budgeting – but really there is only one that fits the bill when it comes to avoiding all of the administrative labor. For this we need to go back to the classic 1926 The Richest Man in Babylon by George Clason where we are introduced to the concept of paying yourself first, a central theme copied by others many times since, and this concept is central to anti-budgeting.

Budgeting after all is nothing more than making sure you save enough money for any of your financial dreams – what better way to do so than by putting the money you need towards these dreams FIRST, before buying yet another book on financial freedom (or whatever).

Therefore, anti-budgeting requires no tracking of any sorts – just put aside a fixed percentage of whatever comes in as soon as it comes in and that’s it! How much to put aside I’ll touch on in another post on saving, but following Clason’s The Richest Man in Babylon it would be 10% of anything that enters your wallet and/or bank account.

Of course, this means that your anti-budget is just a budget with two categories, saving and spending – the most basic budget one could need. More like anti-paperwork. In the end, the order to follow for a successful anti-budget is as followed:

- Save first

- Fixed expenses (they still aren’t going to disappear)

- Do as you please!

To be clear, saving in this case can refer to saving, investing and/or getting rid of debts – although an emergency fund should be saved in the bank first.

The Financial Diet

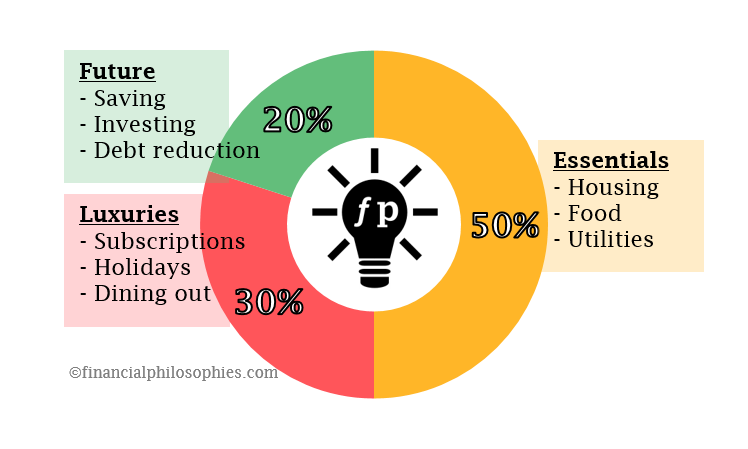

Taking it a step further, there is the 50/30/20 budget popularized by Elizabeth Warren and her daughter Amelia Warren’s book ‘All Your Worth: The Ultimate Lifetime Money Plan’. Their Balanced Money Formula divides the after-tax income into 50% needs (essentials), 30% wants (luxuries) and 20% savings (future, see image).

In contrast to the pay yourself first notion, the Balanced Money Formula actually saves money last, putting a lot of responsibility to keeping within your guidelines for the first two categories. This is done so that you’ll know where to get the money to save, as it should automatically be 20% (or more). A good way to deal with the excuses of ‘I can’t save any money’ – just control the spending first!

For the essentials make sure to not spend more than 50% on essentials such as mortgage payments or rent and food, but also minimum payments on your credit cards – as not doing so would incur more debt, making it an essential for good financial health. Any extra debt reduction would fit into the 20% category. There should be 30% (max.) to spend on the non-essentials such as a Netflix account or going out for dinner. Of course, anything not spend in the 50% or 30% is free to be put into the savings category – however there is a reason to allocate a ‘fun’ budget, as it is a lot easier to keep zealous with a budget if you don’t feel too limited and you can still have a nice dinner out every now and then. The remaining 20% (min.) should go to paying of debt and saving for the future.

These percentages are chosen as they are sustainable, safe and flexible – as with dieting it is hard to keep the change if you limit yourself too much, this is why you can spend 50% on essentials and you should spend on non-essentials, they might not fit exactly for everyone – but that’s okay, approximation is better than being rudderless.

There are some more variations to this, for example Fidelity, an American multinational financial services corporation, has a 50/15/5 rule of thumb, where 50% after-tax goes to essentials, 15% pre-tax to savings and 5% after tax to an emergency fund for unexpected expenses. This addition of a 5% for unexpected expenses is a good addition to having a full 30% to spend on non-essentials and I would definitely recommend having an addition like this.

How about reality?

As I’ve shown in an earlier article about calculating your expected net worth, financial philosophies and the average person don’t usually follow the same path. The same is true here, in 2019 in the Netherlands the average person spent around 55% of their income on essentials such as housing – already breaking the 50% number. But as the authors state in ‘All Your Worth: The Ultimate Lifetime Money Plan’ – if you can make it 55/25/20 it is also okay, just find what works and stick to your plan.

Can’t avoid the paperwork

Budgeting doesn’t work if it does not reflect your own priorities, start with looking back at your spending habits if you can – or start with tracking it for a week or preferably a month or two to find out where you spend your money. You will find that there are certain costs that cannot be avoided, like rent or mortgage payments and costs that are avoidable, but could add value to your quality of life. Try and find the patterns – do you eat out more often than you should? Or perhaps you find out that you spent a big percentage on clothing? These patterns will help you to find out where you might be able to reduce. This way, you can still spend on the essentials without too much stress and focus your budget managing mainly on your non-essentials that you might be overdoing a bit.

Even the anti-budget needs to know where to find the space to save more money – so try to track your expenses. In ‘Your Money or Your Life’, the authors suggest to make a wallchart tracking month by month your income and expenses. By visualizing this, the mind-set will change to reduce the expenses and increase the cash flow over time (see image).

I’ll cover ways to track your income and expenses in a separate post later on (with downloads, so be sure to subscribe to keep updated!).

Send download link to:

Failing your rules

Let’s say you have chosen a rule – regardless of the specific percentage allocated to the different categories, what if you find out that your habits do not match your own rules. Let’s say you are spending more than desired of your income on your essentials, what then? First, be honest with yourself and revisit what you think is an essential – I have met people that were fully convinced that cable TV was an essential, let’s be clear – It is not!

But let’s say you have filled out the categories as you should and still you spend more than you want on essentials. Again, reflect – starting with usually the biggest expense rent or mortgage, do you really need that specific living space? Can you move to a smaller alternative or perhaps to a cheaper neighborhood – or both? Do take all factors into account when considering a change though – moving further away from you job might in turn increase costs for transportation, take all variables into account before making a life altering decision.

Realize that these rules can only be upheld by you and feeling that you cannot possibly reduce your costs means that you are forcing yourself to earn more – after all it is spend less or earn more. In the end spending less will always be easier to control, but don’t let that stop you from aiming to earn more.

How about my rules?

I really like the concept of paying yourself first, a simple concept that eluded me most of my life – I saved the money that was left at the end of the month. This of course leads to sometimes more month than money was left – this simple change made saving a lot easier!

I also like the Balanced Money formula, and try to keep within its bounds, but I try to look at my spending by seeing if I can fulfil a 50/20/20/10 – with the simple change of taking 10% of my non-essentials to create a fourth pillar for the unexpected expenses – so to prevent my savings to be the first source to reach into when these expenses come up (and they always do). This is similar to Ramit Sethi’s Conscious Spending Plan from his book “I Will Teach You to Be Rich” – more on that later.

However, if you have troubles with budgeting – less is more, it is going to be easier to stick to only three essential categories (or two for the anti-budget fans) and once you’ve grown comfortable with this, you can start looking for creating extra separate budgets.

As mentioned in my post about how much to spend on your mortgage, I also try to adhere to the 28/36 debt rule – where maximally 28% of your income should go to housing (incl. mortgage/rent, insurances and the like) – and a total of 36% to debt (incl. the previous 28%). Although I would just prevent debt as a rule – the 28% is a good rule of thumb to find out how much of that 50% on essentials should go to your housing. Stick around to find out in a future post to see how well I can actually fit into all of these budget categories.

I would say that going into this path of financial literacy, the problem has come more in the ‘fun’ budget – where not spending money has its merits and can be fun, the enjoyment to spend money on senseless things has reduced and I feel that I should try to find a better balance here and just blow some money on entertainment more every now and then.

What budgeting philosophy do you adhere to? Share this post along with the thing you enjoy or hate most about budgeting!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?