This article may contain affiliate links. I will make a small commission if you make a purchase through one of these links, at no extra cost to you. This is how I hope to keep the website up and running for years to come! Please read my disclosure for more info.

When I bought a home I was renting a very small studio for a monthly rent similar to a mortgage payment, so I thought why not have a look to buy a home! Was it better to continue renting instead? The rent vs. buy discussion is one that people continue to have, so let’s dive into the discussion to discover the pro’s, the cons and the fallacies.

“The ache for home lives in all of us,

the safe place where we can go as we are and not be questioned.”— Maya Angelou

Why you should keep renting

Renting provides almost complete mobility, if you are in a career or life phase where you will be moving around a lot – or you just don’t know where you’ll be in 5 years – renting is the best option for you.

You’ll also never have a need to sell and incur the associated costs and no risk of equity depreciation when house prices drop. Renting also provides significant financial benefits over homeownership – especially the opportunity presented by not being responsible for maintenance and the low upfront costs of renting, allowing more money to invest elsewhere. More on this below.

The benefits of owning a home

I doubt there is any country where the majority of people don’t see buying a home as a milestone to achieve in their lives – this is immediately the first benefit for owning a home – the pride of ownership. Ownership also brings a lot of freedom, as you are free to make changes to the home without permission from a landlord (within legal limitations). However, homeownership is for sure not something for everybody!

The best known benefit of owning a home is probably the opportunity to build equity with paying down your mortgage and the appreciation of the property. However, in order to make a fair financial comparison – we’ll need to look into this in more detail below.

Renting vs. Buying – what to do!?

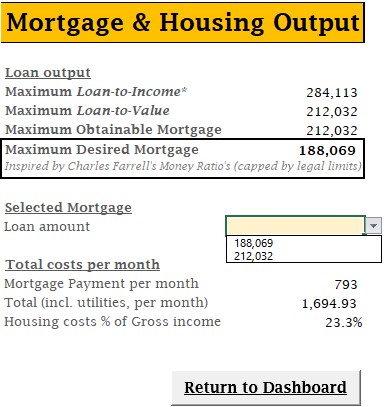

When comparing the financial aspect of renting vs. buying it is easy to take the rent payment and compare it with the mortgage payment (that’s what I did when deciding to buy a home). However, this comparison isn’t exactly fair. While renting a home the costs you make are relatively easy – the rent, owning a home has several factors to consider. Let’s put them together.

One cost is the insurance, which you might also want to have when renting, therefore I will leave this one out for comparison sake. Similarly, utility costs are usually paid for by the renter as well, so also this one I will leave out of consideration. One cost that comes with owning a home is property taxes, which in the Netherlands is a percentage (0 – 2.35%) of the home value added to your taxable income (taxed at 37,35% or 49,50%). Which for the majority of homes (valued € 75.000 – € 1.090.000) will come to an effective rate of ~0.25% – 0.30%, we will take 0.3% to be safe.

Next, as a home owner you are responsible for every repair – as a renter it’s your landlords’ responsibility. Therefore, you’ll need to take into account a maintenance cost (Nibud (Dutch National Institute for Family Finance Information) recommends 1% of the home value per year, i.e. a 250.000 home should take into account 2.500 of costs for maintenance).

Not only the cost itself though, having a home also forces you to keep a higher emergency buffer aside to be able to make these costs at any given time. With a higher emergency budget compared to renting, you’ll be losing out on opportunities to invest this money in the stock market. If you were to buy the home with a down payment you’ll also lose the same opportunity to invest this money while you were still renting (Side note: don’t put your down payment in the stock market if you’re intending to buy within 5 years). Similarly, the estimated 6% closing costs to buying the home will have the same opportunity cost.

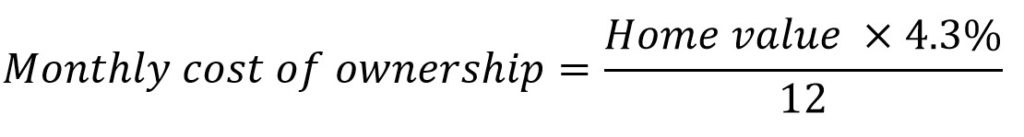

When talking about mortgage payments in comparison to rent – it is important to note that, depending on your mortgage type, a certain amount of your mortgage payment isn’t really lost as it is used to build equity. The interest is the part you should be taking to compare with the cost of renting – together with the opportunity costs this forms your cost of capital when purchasing a home. Cost of capital is explained nicely in this Canadian YouTube video – where we can find that it is safe to say that the cost of capital is about 3% of your home value (although mortgage interest is lower at this moment 3% is still a good estimate taking the opportunity costs into account). This also bring us to a nice formula to compare buying to renting, the 5% rule for Canada. With the Dutch situation, the 5% would however change to 3% + 1% + 0.3% = 4.3% using the numbers stated above.

If these monthly costs are greater than the rent you are currently paying – consider renting a bit longer. Or if you’re still living with your parents and NEED to escape, rent something first.

This calculation of course only provides a snapshot comparison in a point of time, it should be considered that rent will inflate over time and mortgage payments can stay the same or even go down depending on whether or not your interest rate is fixed and the type of mortgage you took. And of course, at the end of your mortgage term – the mortgage costs will disappear completely from this equation (depending on how long you intend to stay put). Also the tax benefits of owning a home should be mentioned- although I personally feel that they don’t necessarily contribute to the decision as they would chage the 3% which I already stated should be fine as is. It isn’t all benefit for homeowners over the long run though, as houses age, their value appreciates – but also their maintenance needs increase reflected in the above formula by an increasing home value and therefore increasing cost of ownership over time.

Rent or buy? Do you miss something here or just think people should live in tents? Let me know below!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?